Peter Broker Bitpanda Doubled To 4.1 Billion In Five Months.

Key Sentence:

- Cryptocurrency trading platform Peter Broker Bitpanda has raised $263 million in a new financing round and is valued at $4.1 billion.

- That’s more than triple Bitpanda’s $1.2 billion worth in its last private funding round five months ago.

Peter Broker Bitpanda is backed by Valar Ventures, a venture capital firm and co-founder of US tech billionaire Peter Teale. Bitpanda, the European trading platform for cryptocurrencies, has raised $263 million in a new financing round and valued the company at $4.1 billion.

That’s more than triple Bitpanda’s $1.2 billion worth in its last private funding round five months ago. The latest cash injection brings the company’s total to nearly $500 million.

The investment did lead by Valar Ventures, a venture funds firm and co-founder of American tech billionaire Peter Teale. This is the third time Valar has backed Bitpanda since its first major funding round was announced in September.

“I don’t like fundraising,” Eric Demut, CEO and co-founder of Bitpanda.

“If you have a partner who is in a close relationship and has deep pockets, you don’t have to do the whole roadshow,” says Humility. “Valar wants to double, and we want to stay with them,” he added. “It was a fairly easy process.” British billionaire hedge fund managers Alan Howard. REDO Ventures and existing investors LeadBlock Partners and Jump Capital are also investing in Bitpanda’s latest round.

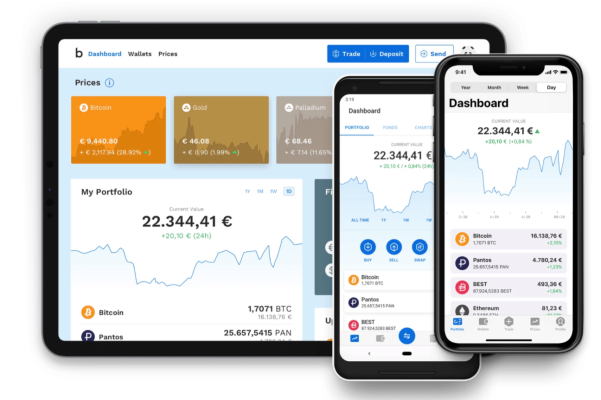

What is Bitpanda?

The company also started testing a service earlier this year to enable consumers to trade stocks around the clock. “I think you’re going to have a delicious stock offering by the end of the year,” Humility said.

Bitpanda is one of the various online brokers in Europe and is attracting increasing investor interest thanks to the trading meme fund craze. Retailers piled on unpopular promotions like GameStop and AMC and took inspiration from popular Reddit forums. This has increased trading volume on digital platforms like Robinhood.

One way to differentiate yourself of the competition is to license your technology to banks and fintech companies. He declined to name customers but said several large companies are already implementing the system and will offer crypto and stock trading within months. Bitpanda makes money from the difference between what someone is willing to pay for an asset and the price on which the asset is sold. This introduction has been profitable for five years, says Humility.

Profitability is rare in Peter Broker Bitpanda as many companies are at risk of making huge losses. For example, Revolut, last valued at $33 billion, lost £167.8 million ($232.3 million) in 2020, up 57 percent from a year earlier. Demuth said several fintech companies raise money for high scores through “advertising” and “fear of missing out.”

“I was very skeptical about that,” he said. “Many companies, especially those in fintech, are based entirely on a combination of hype and growth. But growth is mainly paid for, so you have a free product, and you get your customers to buy it. “Bitpanda has not detailed how much money it makes annually, but sales will increase sevenfold by 2021. The platform already has more than 3 million users.

The company operates only in Europe and has offices in Vienna, Berlin, London, Paris, Barcelona, Milan, and Krakow. The money will expand in key markets such as France, Spain, Italy, and Portugal.

Crypto mania

Bitpanda’s rise in rankings comes at a time of significant momentum for the burgeoning cryptocurrency industry. Digital currency investors have seen a boom this year, with Bitcoin and other major cryptocurrencies hitting record highs in April and May before collapsing in the coming weeks. Recently, Bitcoin and the smaller digital coin, Ether, have seen a strong resurgence, pushing the entire crypto market above the $2 trillion marks for the first time in three months.

The main wind for crypto these days is the threat of regulation. China has taken steps to invest in digital assets speculatively, while a recently passed US infrastructure bill includes provisions that crypto advocates say could harm the industry.

Europe regulates the crypto industry more slowly than its global counterparts, Humility said. However, it was prompted by new EU rules that aim to put the sector under government oversight. “From the designs I’ve seen so far, it doesn’t look like it’s going to have a bad impact,” he said. “Of course, you can always mess something up at the last minute.”